When Your ERP Isn’t Telling the Whole Story

One growing B2B brand came to us with a common pain point: Square was processing their orders, but NetSuite—their ERP—wasn’t capturing everything. Orders made it through, but the transaction-level fees and bank deposits never did. It left their finance team flying blind.

Instead of a single source of truth, they had two: Square reports and NetSuite records. And they didn’t match. Every reconciliation cycle became a manual process. That meant logging into multiple platforms, running manual reports, and spending hours cross-referencing data just to figure out what money came in and what fees were taken out.

For any business dealing with hundreds of transactions a week, that’s more than an inconvenience. It’s a bottleneck.

Why Manual Reconciliation Fails in B2B Operations

Anyone who’s ever tried to reconcile third-party payments without automation knows the pain. Reconciliation is vital—not just for accurate books, but for making confident decisions across finance, ops, and leadership. Revenue reporting, cash flow forecasting, and even vendor payments rely on accurate, timely financial data. When fees or deposit mismatches go undetected, it can delay month-end closes, introduce reporting errors, and force finance teams into reactive mode.

In this case, every Square payout triggered a mini fire drill. Deposits would hit the bank account, but no one could immediately say what orders they covered—or how much was skimmed in processing fees. And with that level of uncertainty, trusting the books became a challenge.

Without a direct match in NetSuite, manual reconciliation may work at low volume, but it doesn’t scale. This brand was ready for better.

Designing a Seamless Square-to-NetSuite Integration

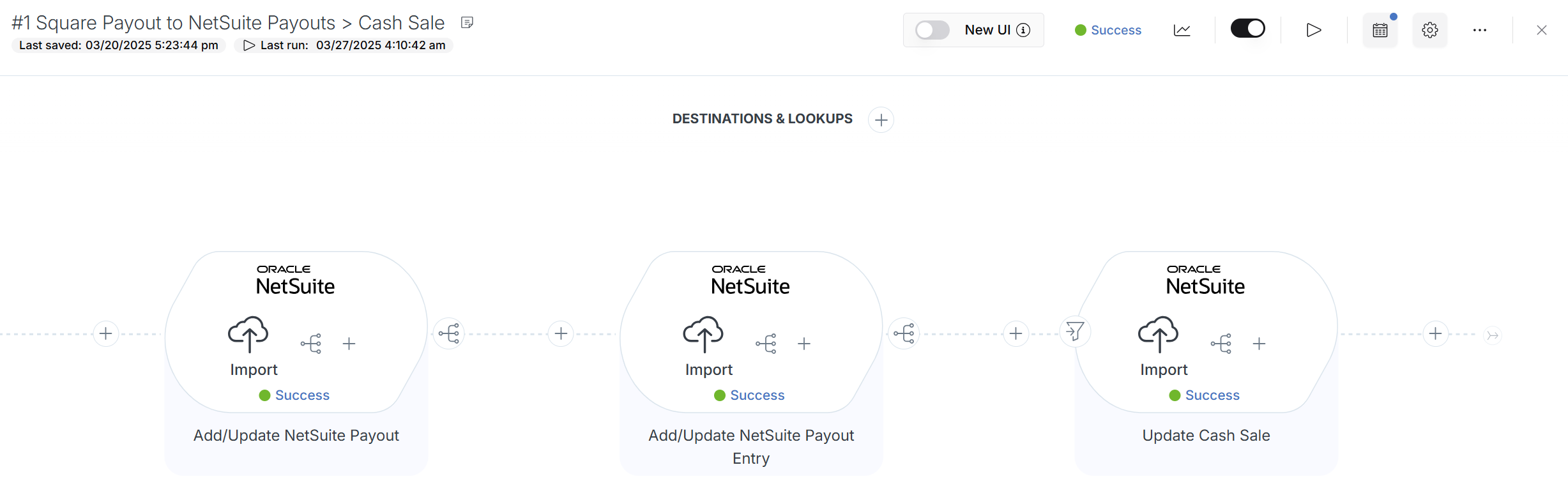

That’s where Hairball stepped in. Over a 7-week period, we built and launched an integration between Square and NetSuite that automated the entire reconciliation process.

What we delivered:

- Automated Fee Mapping: We set up logic to retrieve Square’s transaction-level fees and apply them to their corresponding sales orders in NetSuite. This ensures that financial records reflect not just gross sales, but net revenue.

- Payout Matching with Bank Deposits: Each Square payout is now mirrored in NetSuite as a clean, consolidated bank deposit. No manual entry. No room for error. Everything ties out to the penny.

- Full Reconciliation in Clicks, Not Hours: With the right data flowing into the right fields, the finance team can now reconcile Square payouts with confidence—directly inside NetSuite, in just a few clicks.

The Ripple Effect of Automation

The results speak for themselves: since the integration went live on March 18, there have been zero post-launch errors. But the benefits go far beyond clean data.

Now, month-end closes happen faster. Financial reporting is more accurate. Leadership gets real-time visibility into cash flow. And the finance team? They’ve gained back hours each week to focus on strategy instead of spreadsheets.

It’s not just a win for finance—it’s a win for the entire organization.

This Is What Scalable Financial Automation Looks Like

This integration isn’t just a fix for today—it’s a framework for the future. By centralizing data in NetSuite and building logic for transaction-level accuracy, the brand now has a reliable foundation they can extend to other payment platforms, retail POS systems, or even marketplaces.

As they grow, their systems won’t just keep up—they’ll guide the way forward.

Still stitching together payouts and fees by hand?

Hairball makes financial automation easy, accurate, and tailored to your business. Let’s make your ERP work for you.