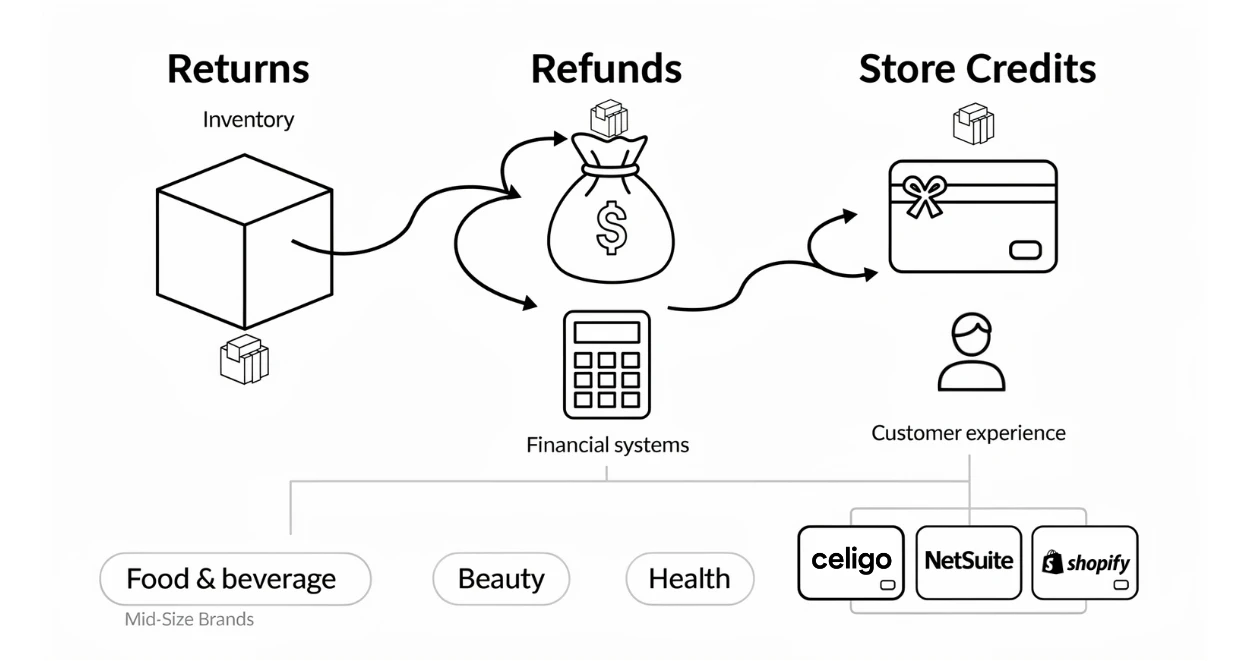

Returns, refunds, and store credits are often conflated in retail operations, but they have distinct impacts on inventory and financial systems, and misunderstanding them can lead to inaccurate inventory positions, flawed financial reporting, as well as poor customer experiences. This is especially true for product brands navigating rapid growth in food & beverage, beauty and health sectors where SKU complexity and omnichannel demand are high.

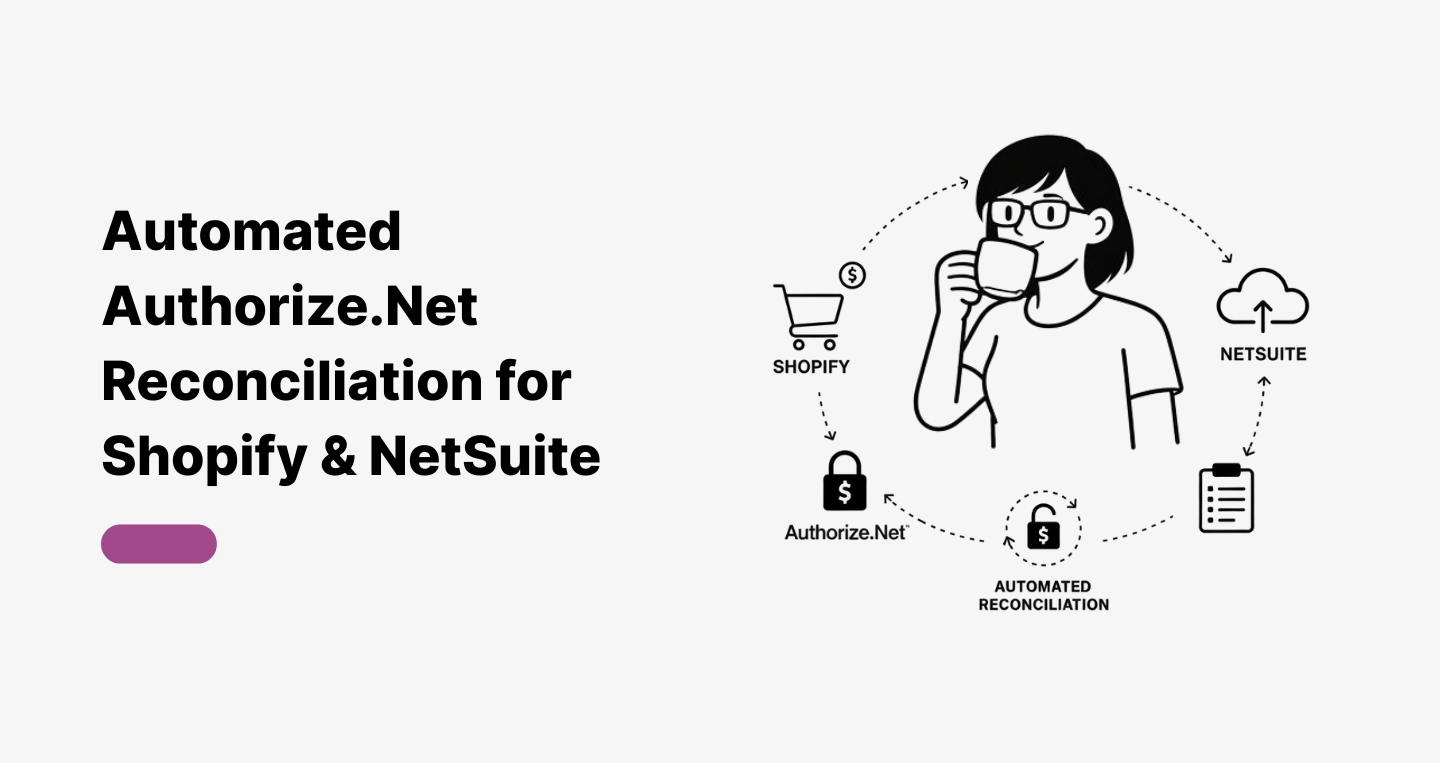

Platforms like Celigo, when correctly implemented and integrated with NetSuite and eCommerce platforms like Shopify, can ensure your operational data flows accurately between systems, if you handle these events intentionally.

Refunds vs. Returns: Why They’re Not Interchangeable

Refunds: Financial Impact Without Necessarily Touching Inventory

A refund is a financial transaction that reimburses a customer, but it doesn’t automatically adjust inventory. A refund entry in Shopify or NetSuite can be created without referencing specific items, which means:

- You might issue a refund that doesn’t decrement inventory, because no returned item was logged.

- The refund could hit your general ledger without an associated SKU movement.

This disconnect is common when customer support teams manually create refunds without including the returned line items. If the refund JSON doesn’t have associated line items, the system treats it purely as a financial adjustment, and your inventory remains unchanged.

Returns: Operational Impact That May Not Touch the Ledger

By contrast, a return is a physical inventory movement. It signals that stock needs to be received back into a location. But unless the return is tied to a corresponding financial adjustment (either through a refund or store credit), it might not register in your financial reporting.

Key operational pitfalls include:

- Returns marked without specifying the return location.

- Returns logged without linking to a corresponding refund or credit entry.

- Returns without restocking flags, leading to ambiguous inventory positions.

Shopify has a specific option for “Restock Items”. If that option isn’t checked, NetSuite and your systems may see a return with no location and inventory remains unadjusted. That leads to confusion later when someone tries to reconcile stock or answer customer inquiries. Accurate restocking flags are essential for true inventory integrity.

Store Credits: A Separate Animal With Lifecycle Impacts

Shopify now supports store credits as a refund method, which further complicates operational automation.

Unlike straightforward refunds:

- Store credits do not return money, they issue value for future purchases.

- They affect customer orders later, because credits can be redeemed against new carts.

- Balances live in customer accounts rather than being reflected immediately in financial refund metrics.

This means that store credits must be translated properly into both your financial systems (for revenue recognition and liability tracking) and your inventory/inventory forecasting models.

Risks of Conflation

If your team treats refunds, returns, and store credits as interchangeable, you risk:

- Inventory discrepancies between Shopify and NetSuite

- Financial inaccuracies, especially for revenue reconciliation

- Customer experience gaps (e.g., credits not applied correctly or stock levels misreported)

- Reporting errors that skew insights for replenishment planning

For brands where margin and inventory precision matter (like fashion, footwear, beauty, or food & beverage), these errors compound quickly.

How Automation With Celigo + NetSuite Solves These Challenges

To mitigate risk and scale efficiently, mid-size brands need automation that understands these business events and routes them correctly across platforms. This is where Celigo integrations (expertly implemented) shine.

1. Syncing Returns With Inventory and Financial Systems

An integrated flow between Shopify and NetSuite ensures that:

- Returns properly update inventory when the “Restock” flag is set.

- Line items are tied to return events so inventory and financial systems interpret them accurately.

- Items returned without appropriate flags generate exceptions that can be queued for manual review or automated correction rules.

2. Automating Refund Logic With Correct Line Items

With the right integration logic:

- Refunds are only issued with item line context, avoiding empty refund adjustments.

- Financial entries in NetSuite reflect the true nature of the refund, cash, credit, or liability movement.

- Partial refunds and restock exceptions can be configured as structured flows so operations teams see predictable outcomes.

3. Supporting Store Credits as First-Class Business Events

Rather than treating store credits as an afterthought:

- Credits can be captured as discrete transactions that flow into finance systems as liabilities.

- Redemption events link back to orders and inventory use, preventing phantom inventory shortages or misallocated revenue.

Strategic Value for Mid-Size or Enterprise Brands

For product companies, the stakes around refunds and returns are operational and financial:

- Inventory accuracy is essential for planning and fulfillment across channels.

- Revenue recognition and liability tracking influence forecasting, especially with store credits.

- Customer experience hinges on predictable flows for returns, refunds, and credits, driving retention in competitive verticals.

Automated integration between your eCommerce platform and internal ERP – executed with a partner who understands retail flows and data context – gives you:

- Operational clarity

- Financial accuracy

- Scalability without manual patching

Companies partnering with Hairball have streamlined these data flows efficiently while offloading integration complexity so their internal teams can focus on growth and service delivery.

Final Takeaways

- Refunds, returns, and store credits are different events with different impacts — treat them as such in your logic and automation.

- Proper integration flows between Shopify, NetSuite, and automation middleware like Celigo ensure these events update inventory and financial ledgers as expected.

- Investing in robust automation with experienced implementation partners minimizes risk and improves decision-making accuracy.

If your product company is wrestling with inconsistent inventory, opaque financial reporting, or unclear customer credit usage, a clear automation strategy with end-to-end integration is foundational to scaling predictably.

If you’d like to discuss how your brand can streamline refunds, returns, and store credit workflows across Shopify and NetSuite, feel free to schedule a call with our team to explore the right integration approach.