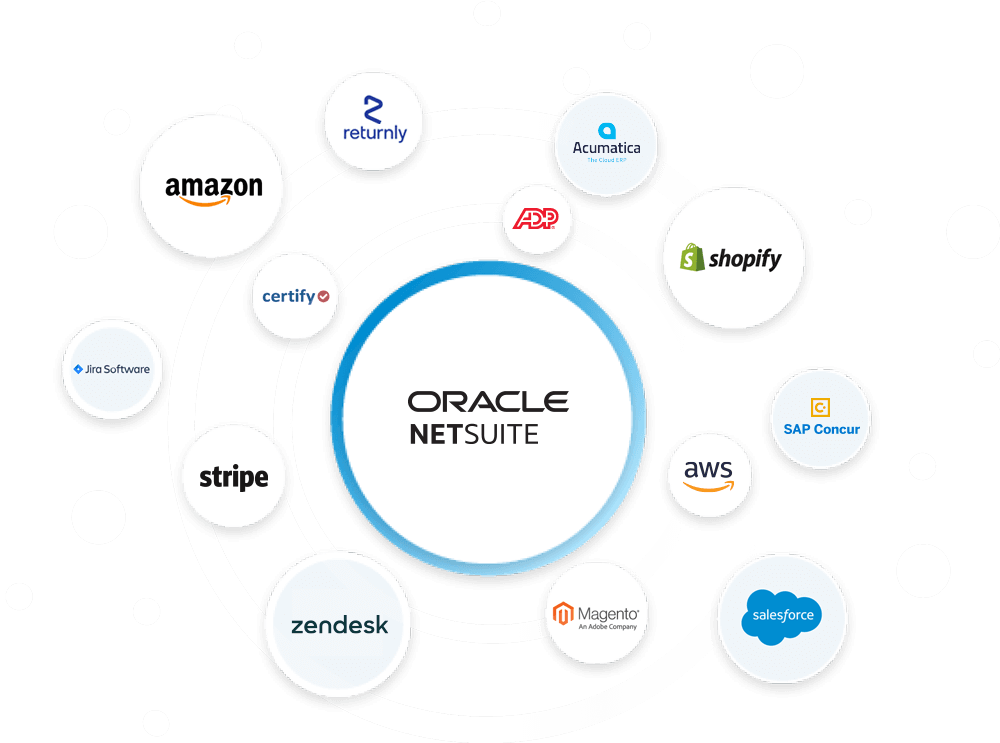

Shopify’s introduction of Store Credit, accessible via the GraphQL API, could have significant implications for Shopify to NetSuite integrations, especially for businesses that rely on seamless data synchronization between their e-commerce platform and ERP system. Here’s how this new feature might impact the integration process, considering Hairball’s expertise in NetSuite, e-commerce, and Celigo:

Enhanced Customer Experience

- Unified Accounts Receivable Management: By integrating store credit information from Shopify into NetSuite, businesses can manage customer credits more efficiently. This ensures that customer balances are accurately reflected across both platforms, enhancing trust and satisfaction.

- Personalized Marketing and Sales Strategies: With access to store credit data, companies can tailor their marketing and sales efforts more effectively, offering personalized promotions based on the customer’s available credit.

Improved Financial Reporting

- Accurate Financial Statements: Integrating store credit transactions into NetSuite allows for real-time visibility into liabilities associated with issued credits. This accuracy is crucial for financial reporting and forecasting.

- Streamlined Reconciliation Processes: Automating the transfer of store credit data into NetSuite simplifies the reconciliation process, reducing manual errors and saving time for finance teams.

Operational Efficiency

- Automated Workflows: By leveraging Hairball’s expertise in NetSuite scripts and workflows, businesses can automate the process of updating store credit balances. This minimizes manual intervention and ensures that the data across Shopify and NetSuite remains synchronized.

- Enhanced Returns Management: For businesses focusing on Returns Management, integrating store credit features can optimize the returns flow. It allows for smoother processing of returns by automatically updating the store credit balance in Shopify when a return is processed in NetSuite.

Technical Considerations

- API Integration Challenges: The integration of Shopify’s GraphQL API with NetSuite may require custom development. Hairball’s proficiency in integrating customer service systems and leveraging NetSuite’s capabilities will be invaluable in overcoming these challenges.

- Data Synchronization: Real-time or near-real-time data synchronization between Shopify and NetSuite is crucial. Any delays or discrepancies in store credit information could lead to customer dissatisfaction or accounting inaccuracies.

Compliance and Security

- Data Privacy and Security: Ensuring the secure transfer of store credit data between Shopify and NetSuite is paramount. Compliance with data protection regulations must be considered during the integration process.

Conclusion

The introduction of Store Credit in Shopify and its accessibility via the GraphQL API presents an opportunity for businesses to enhance their operational efficiency, customer experience, and financial reporting. Given Hairball’s extensive expertise in NetSuite, e-commerce, and Celigo, as well as our specialization in areas like Returns Management, we are well-positioned to help clients navigate these changes. Integrating this new feature will require a thoughtful approach to API integration, data synchronization, and compliance, areas where Hairball excels.